Xero users can now generate withholding tax certificates, VAT reports and monthly returns in compliance with the Thai revenue code. ThaiTax and Xero synchronize in real time.

Features

ThaiTax enables Thailand based businesses to safeguard their tax compliance with local regulations.

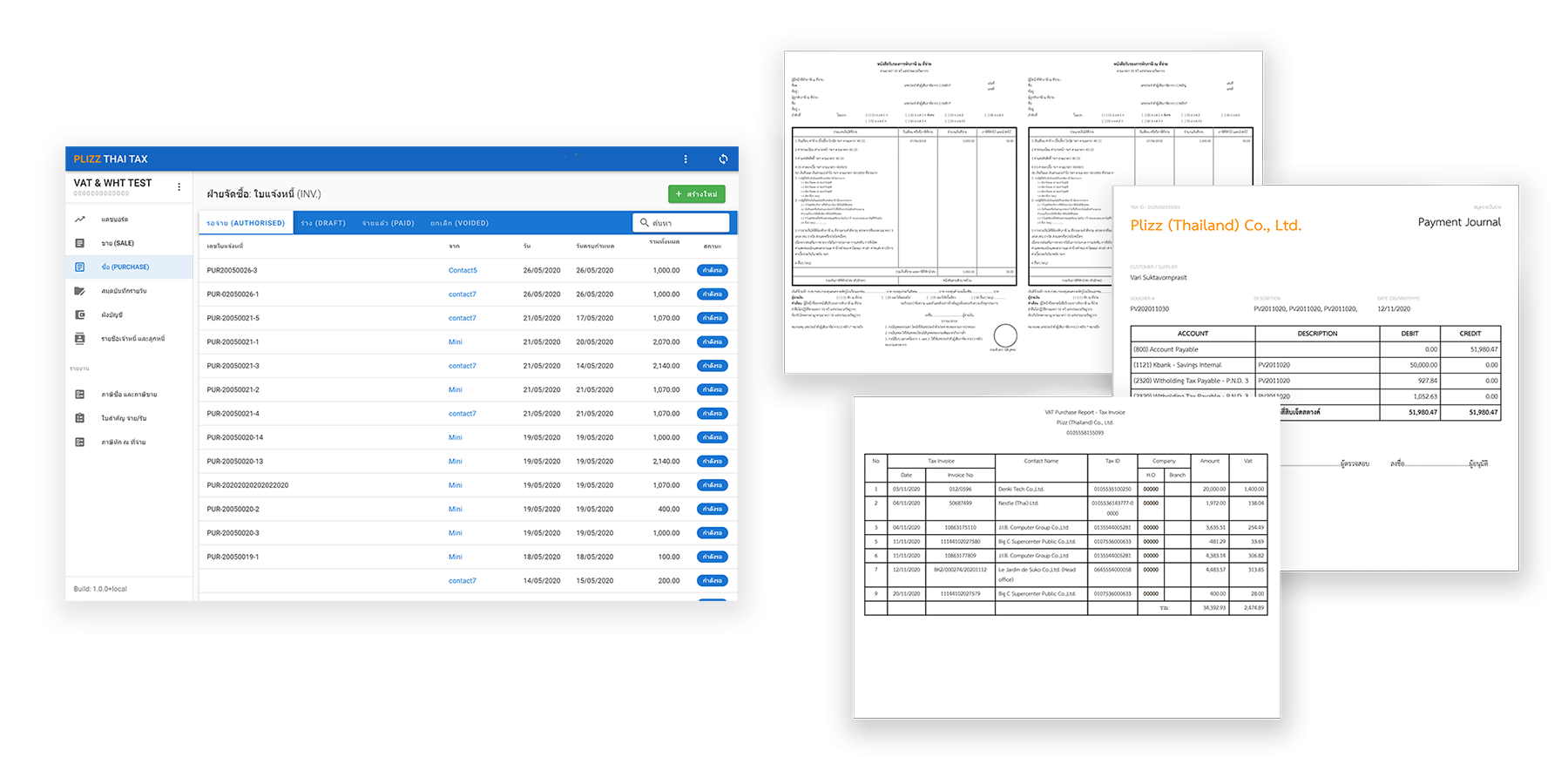

Record, View, Export. No duplicated work with Xero

Users can update data indifferently in either ThaiTax or Xero (invoices, bills, manual journals, contacts information, chart of accounts, tracking categories) and generate VAT reports & monthly returns in compliance with the Thai revenue code, as well as issue withholding tax certificates and generate transactions vouchers.

Xero plug-in generating tax reports in compliance with Thailand tax regulations

*No credit card required.